Why Proper Bookkeeping is Crucial for Foreign SMEs in Thailand

For many foreign-owned small and medium-sized enterprises (SMEs) in Thailand, bookkeeping is often seen as a routine administrative task. However, proper bookkeeping is far more than just record-keeping—it is a critical part of compliance, financial control, and long-term business success.

1. Legal Requirement

Under the Accounting Act B.E. 2543 (2000), all companies registered in Thailand must:

- Maintain accurate accounting records in accordance with Thai Financial Reporting Standards (TFRS).

- Record transactions in Thai language and currency (Thai Baht).

- Keep accounting records for at least five years for audit and inspection purposes.

2. Tax Compliance

Accurate bookkeeping ensures that:

- Value Added Tax (VAT) filings are based on correct tax invoices and receipts.

- Withholding tax submissions are supported by proper documentation.

- Corporate Income Tax filings (P.N.D. 50 and P.N.D. 51) are consistent with accounting records.

Errors in bookkeeping can lead to penalties, tax reassessments, or difficulties during an audit.

3. Supporting the Annual Audit

Auditors rely on bookkeeping records to verify financial statements. Without proper bookkeeping:

- The audit process becomes more time-consuming and costly.

- Missing documents may result in disallowed expenses and higher tax liabilities.

- Companies risk non-compliance with statutory deadlines.

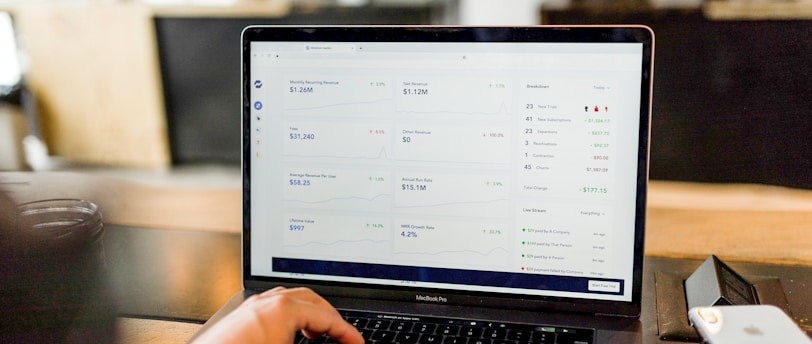

4. Business Insights and Decision-Making

Beyond compliance, proper bookkeeping provides management with reliable financial data to:

- Track profitability by product, service, or branch.

- Manage cash flow effectively.

- Present credible financial information to investors, banks, or business partners.

5. Benefits of Outsourcing Bookkeeping

For foreign SMEs, outsourcing bookkeeping to a professional accounting firm offers:

- Local expertise in Thai accounting standards and tax rules.

- Reduced administrative burden on internal staff.

- Assurance that records are audit-ready and tax-compliant.

This allows business owners to focus on growth while maintaining full compliance with Thai regulations.

Conclusion

Proper bookkeeping is not just about meeting legal requirements—it is a foundation for tax compliance, successful audits, and informed business decisions. By partnering with a professional bookkeeping service, foreign SMEs in Thailand can ensure accuracy, compliance, and long-term financial health.